How Brexit has helped to expose Italy’s banking malaise

Brexit has triggered a financial chain reaction that has also exposed the problems of the Italian banking system.

The UK’s decision to leave the EU made investors fearful that the union would face a new crisis or even break up. This led to a swift withdrawal of their funds from the most fragile sections of Europe’s financial markets.

Italian banks are one of these areas. The graph below shows the steep fall of Italy’s FTSE Italia All-Share banks index following the UK’s referendum result.

The main problem with Italy’s banks is that they are swamped with what are known as non-performing loans (NPLs). These are loans on which debtors have not made scheduled payments for at least 90 days.

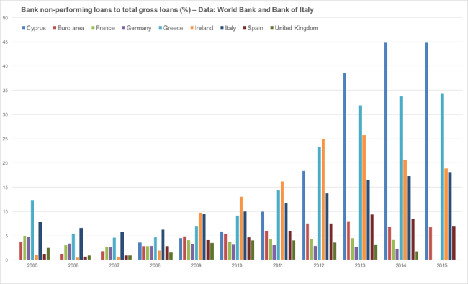

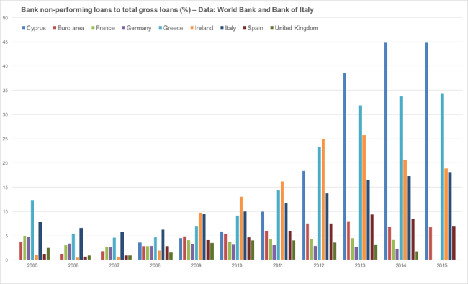

In other words, Italian banks are not getting back some of the money they have lent out. According to data from the Bank of Italy, NPLs of Italian banks amounted to €360 billion in 2015, or 18.1% of all loans they made (see graph below). Of these loans, €210 billion are really bad and no longer collectable. The remaining €150 billion are of slightly higher quality.

Italian banks are incredibly exposed to NPLs. They equal almost a quarter of Italy’s GDP and a third of the total NPL exposure of EU members. Practically speaking, NPLs are a big drag on the ability of Italian banks to finance investments and growth in the real economy. Accordingly, it is a major threat to the stability of the entire EU.

The NPL problem has its origins in the seven-year recession that followed the 2008 global financial crisis and the ensuing European sovereign debt crisis. The reason is simple: if the economy does not go well, companies and households struggle to repay their debt to the banks.

However, another cause of the NPL problem is the fact that Italian bank managers also made bad investment decisions, often allocating loans on the basis of favouritism. Hence, it would not be an exaggeration to say that an independent inquiry on the issue should be established, a sort of NPL audit which should be open to independent experts and civil society.

Government incapacity

Another cause of the NPL crisis is the Italian government’s inability to solve the issue, as other European countries have. Germany and France for example intervened directly with state funds to provide new capital to their banks, thanks also to relatively more solid public finances.

Ireland and Spain have instead used bad banks co-funded by both state and private investors. These so-called bad banks use these funds to buy other financial institutions' bad loans. They focus on managing the non-performing assets, for instance by trying to recover the money from borrowers. The other institutions, relieved of their bad debts, can instead healthily resume their normal activities of lending and borrowing. Direct state bail-out and bad banks are not mutually exclusive solutions. In fact, they are often used together.

In the case of Italy, the government could not intervene directly with public money. Italy’s huge public debt does not give fiscal space for substantial public funds going to struggling banks. Some exceptions were made for several banks including Banca Monte dei Paschi di Siena in the period 2008-2012.

More importantly, by the time the Italian government decided it would do something about four small troubled banks in 2015, new EU rules, including a bail-in, were already on their way to being fully implemented. These dictate that when a bank is in crisis, its creditors – bondholders and depositors together with shareholders – would bear the burden by having part of the debt they are owed written off. This was so that governments could avoid rescuing banks using taxpayer money.

To cut a long story short: Italy’s banks are in a dire enough situation to require direct state intervention, but this cannot be done under current EU banking regulation. As a result, the Italian government is negotiating with the European Commission to develop alternative and more complex solutions which avoid relying on taxpayer money. Unfortunately, these would merely keep the banks alive, but do not thoroughly restructure their governance and business strategies so that they could start lending again.

At this point, the most appropriate solution would be to inject public capital into the banking system under strict conditions which impose a more effective governance and business strategy on the bailed-out banks. The Swedish case in 1992 shows that banks can be held responsible and the government can become an owner. What is more, the Swedish government was also able to make a profit once it sold the shares of the banks later on.

Direct state intervention would prevent small investors from having their savings wiped out. These retail investors hold a third of all bonds issued by Italian banks, but are not always fully aware of the risks their bank managers exposed them to. More generally, direct state intervention would help kickstart economic growth in a country that so desperately needs it.

Andrea Lagna, Lecturer in International Business, Strategy and Innovation, Loughborough University

This article was originally published on The Conversation. Read the original article.

Comments

See Also

The UK’s decision to leave the EU made investors fearful that the union would face a new crisis or even break up. This led to a swift withdrawal of their funds from the most fragile sections of Europe’s financial markets.

Italian banks are one of these areas. The graph below shows the steep fall of Italy’s FTSE Italia All-Share banks index following the UK’s referendum result.

The main problem with Italy’s banks is that they are swamped with what are known as non-performing loans (NPLs). These are loans on which debtors have not made scheduled payments for at least 90 days.

In other words, Italian banks are not getting back some of the money they have lent out. According to data from the Bank of Italy, NPLs of Italian banks amounted to €360 billion in 2015, or 18.1% of all loans they made (see graph below). Of these loans, €210 billion are really bad and no longer collectable. The remaining €150 billion are of slightly higher quality.

Italian banks are incredibly exposed to NPLs. They equal almost a quarter of Italy’s GDP and a third of the total NPL exposure of EU members. Practically speaking, NPLs are a big drag on the ability of Italian banks to finance investments and growth in the real economy. Accordingly, it is a major threat to the stability of the entire EU.

The NPL problem has its origins in the seven-year recession that followed the 2008 global financial crisis and the ensuing European sovereign debt crisis. The reason is simple: if the economy does not go well, companies and households struggle to repay their debt to the banks.

However, another cause of the NPL problem is the fact that Italian bank managers also made bad investment decisions, often allocating loans on the basis of favouritism. Hence, it would not be an exaggeration to say that an independent inquiry on the issue should be established, a sort of NPL audit which should be open to independent experts and civil society.

Government incapacity

Another cause of the NPL crisis is the Italian government’s inability to solve the issue, as other European countries have. Germany and France for example intervened directly with state funds to provide new capital to their banks, thanks also to relatively more solid public finances.

Ireland and Spain have instead used bad banks co-funded by both state and private investors. These so-called bad banks use these funds to buy other financial institutions' bad loans. They focus on managing the non-performing assets, for instance by trying to recover the money from borrowers. The other institutions, relieved of their bad debts, can instead healthily resume their normal activities of lending and borrowing. Direct state bail-out and bad banks are not mutually exclusive solutions. In fact, they are often used together.

In the case of Italy, the government could not intervene directly with public money. Italy’s huge public debt does not give fiscal space for substantial public funds going to struggling banks. Some exceptions were made for several banks including Banca Monte dei Paschi di Siena in the period 2008-2012.

More importantly, by the time the Italian government decided it would do something about four small troubled banks in 2015, new EU rules, including a bail-in, were already on their way to being fully implemented. These dictate that when a bank is in crisis, its creditors – bondholders and depositors together with shareholders – would bear the burden by having part of the debt they are owed written off. This was so that governments could avoid rescuing banks using taxpayer money.

To cut a long story short: Italy’s banks are in a dire enough situation to require direct state intervention, but this cannot be done under current EU banking regulation. As a result, the Italian government is negotiating with the European Commission to develop alternative and more complex solutions which avoid relying on taxpayer money. Unfortunately, these would merely keep the banks alive, but do not thoroughly restructure their governance and business strategies so that they could start lending again.

At this point, the most appropriate solution would be to inject public capital into the banking system under strict conditions which impose a more effective governance and business strategy on the bailed-out banks. The Swedish case in 1992 shows that banks can be held responsible and the government can become an owner. What is more, the Swedish government was also able to make a profit once it sold the shares of the banks later on.

Direct state intervention would prevent small investors from having their savings wiped out. These retail investors hold a third of all bonds issued by Italian banks, but are not always fully aware of the risks their bank managers exposed them to. More generally, direct state intervention would help kickstart economic growth in a country that so desperately needs it.

Andrea Lagna, Lecturer in International Business, Strategy and Innovation, Loughborough University

This article was originally published on The Conversation. Read the original article.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.