Codice fiscale: How to get your Italian tax code (and why you need one)

One of the first and most important things new residents in Italy need is a codice fiscale, or tax code. Here's a quick guide to getting yours.

What is it and why do I need one?

A codice fiscale is a personal identification number similar to a Social Security number in the US or National Insurance number in the UK.

But it's not just used for employment or paying taxes. Unlike in the UK where you get your NI number at the age of 16, Italy issues the codice fiscale at birth.

Whether you'll be working or not, the code is essential for everyday activities. You'll need it to do practically anything; from opening a bank account to buying property, and you'll even need to enter it when making some online purchases.

READ ALSO: What you need to know about opening a bank account in Italy

And if you weren't born in Italy, you'll still need to get hold of this number as soon as you start your life here.

Is it difficult to get?

The good news is that it's relatively quick and easy to get hold of. You can get your own codice fiscale even if you don't speak much of the language – and even if you're not in the country.

How much does it cost?

Getting your Italian tax code is free. There should be no charges made by Italian authorities at any stage of the process.

However, some readers have reported being charged up to 250 euros by unscrupulous middlemen who'll make the application on your behalf - and claim there are hefty fees involved. There aren't.

If you choose to use the services of a lawyer or translator they may of course charge their own fees, but the application itself costs nothing.

How do I apply?

If you're not in Italy, visit the Italian embassy or consulate in your country to apply. Some embassies also provide an online application form.

You can also have a legal professional in Italy obtain the tax code on your behalf.

If you are in Italy, non-EU citizens applying for the tax code will need to visit one of three offices, depending on their reasons for applying.

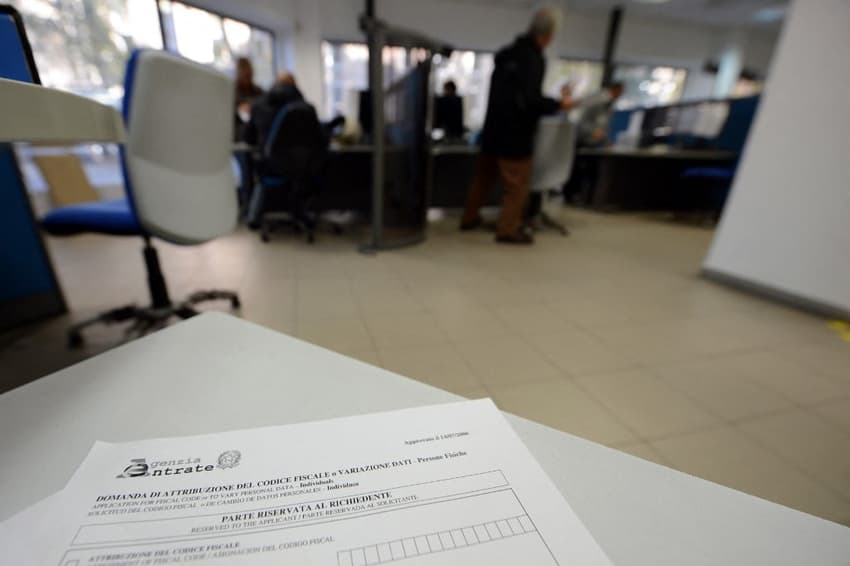

According to the Agenzie delle Entrate (Italian Revenue Agency, or tax office), people entering the country "either for employment purposes or to reunite with their family" must apply for a codice fiscale at the immigration desk at their local prefettura (prefecture), known as the 'Sportello Unico per l’immigrazione'.

Meanwhile, foreign nationals "who require either the issuance or renewal of a residence permit" should apply for the tax code via their local Questura, the province's police headquarters.

READ ALSO: How foreign nationals can apply for an Italian ID card

"In any other situation the tax identification number can be obtained from the offices of the Italian Revenue Agency," the tax office website states.

Citizens of non-EU Countries need to show at least one of the following documents when applying:

- a valid passport with visa (if required), or any other document accepted by the Italian authorities

- a certificate of identity issued by the Italian diplomatic or consular authorities of the Country of nationality (with photo)

- a valid residence permit (permesso di soggiorno)

- an ID card issued by the municipality of residence in Italy.

"Non-EU citizens must also prove that they have the right to stay, even temporarily, in Italy," the website states.

Meanwhile, EU citizens can apply for the tax identification number at any Agenzie delle Entrate office. Find your nearest office here.

Along with the application form, which the tax office will provide (although perhaps not in English), you'll need to show a valid identification document (identity card or passport).

When will I get my codice fiscale?

You should be assigned your code immediately at the office if you're applying in person. The tax office will print out a piece of paper with your number on there and then.

A plastic card (tesserino) carrying the same information should be posted a few weeks later to the address you gave on the application form.

If you later apply for a tessera sanitaria, or Italian state health insurance card, your codice fiscale will also be printed on the back of that.

READ ALSO: Who can register for national healthcare in Italy?

If you lose your codice fiscale or tessera sanitaria, you can request a replacement online.

Please note The Local is unable to assist with applications. For more information about getting a codice fiscale, see the Italian tax office's website here (in English).

Find more guides to navigating Italian paperwork in our bureaucracy section.

Comments (5)

See Also

What is it and why do I need one?

A codice fiscale is a personal identification number similar to a Social Security number in the US or National Insurance number in the UK.

But it's not just used for employment or paying taxes. Unlike in the UK where you get your NI number at the age of 16, Italy issues the codice fiscale at birth.

Whether you'll be working or not, the code is essential for everyday activities. You'll need it to do practically anything; from opening a bank account to buying property, and you'll even need to enter it when making some online purchases.

READ ALSO: What you need to know about opening a bank account in Italy

And if you weren't born in Italy, you'll still need to get hold of this number as soon as you start your life here.

Is it difficult to get?

The good news is that it's relatively quick and easy to get hold of. You can get your own codice fiscale even if you don't speak much of the language – and even if you're not in the country.

How much does it cost?

Getting your Italian tax code is free. There should be no charges made by Italian authorities at any stage of the process.

However, some readers have reported being charged up to 250 euros by unscrupulous middlemen who'll make the application on your behalf - and claim there are hefty fees involved. There aren't.

If you choose to use the services of a lawyer or translator they may of course charge their own fees, but the application itself costs nothing.

How do I apply?

If you're not in Italy, visit the Italian embassy or consulate in your country to apply. Some embassies also provide an online application form.

You can also have a legal professional in Italy obtain the tax code on your behalf.

If you are in Italy, non-EU citizens applying for the tax code will need to visit one of three offices, depending on their reasons for applying.

According to the Agenzie delle Entrate (Italian Revenue Agency, or tax office), people entering the country "either for employment purposes or to reunite with their family" must apply for a codice fiscale at the immigration desk at their local prefettura (prefecture), known as the 'Sportello Unico per l’immigrazione'.

Meanwhile, foreign nationals "who require either the issuance or renewal of a residence permit" should apply for the tax code via their local Questura, the province's police headquarters.

READ ALSO: How foreign nationals can apply for an Italian ID card

"In any other situation the tax identification number can be obtained from the offices of the Italian Revenue Agency," the tax office website states.

Citizens of non-EU Countries need to show at least one of the following documents when applying:

- a valid passport with visa (if required), or any other document accepted by the Italian authorities

- a certificate of identity issued by the Italian diplomatic or consular authorities of the Country of nationality (with photo)

- a valid residence permit (permesso di soggiorno)

- an ID card issued by the municipality of residence in Italy.

"Non-EU citizens must also prove that they have the right to stay, even temporarily, in Italy," the website states.

Meanwhile, EU citizens can apply for the tax identification number at any Agenzie delle Entrate office. Find your nearest office here.

Along with the application form, which the tax office will provide (although perhaps not in English), you'll need to show a valid identification document (identity card or passport).

When will I get my codice fiscale?

You should be assigned your code immediately at the office if you're applying in person. The tax office will print out a piece of paper with your number on there and then.

A plastic card (tesserino) carrying the same information should be posted a few weeks later to the address you gave on the application form.

If you later apply for a tessera sanitaria, or Italian state health insurance card, your codice fiscale will also be printed on the back of that.

READ ALSO: Who can register for national healthcare in Italy?

If you lose your codice fiscale or tessera sanitaria, you can request a replacement online.

Please note The Local is unable to assist with applications. For more information about getting a codice fiscale, see the Italian tax office's website here (in English).

Find more guides to navigating Italian paperwork in our bureaucracy section.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.