Who needs to pay the Italian TV licence fee - and how to cancel it

Italy's TV licensing fee is applied differently than in many other countries, and the opt-out system means you could be paying it unnecessarily. Here's who needs to pay it, and how to cancel.

Who needs to pay?

If you own a house in Italy and have one or more television sets in it, you’ll have to pay the national TV licence fee (canone).

This goes for both Italian residents and foreign residents who own property in the country.

How do I pay?

Paying the TV licence fee in Italy is relatively straightforward as it’s automatically added to a household’s electricity bill (no prior arrangement is required).

In most cases, it’ll show up as a seven-euro (previously nine-euro) monthly charge on electricity bills from January to October, for a total of 70 euros.

Some energy providers may occasionally bill it differently, which is why it's advisable to check exactly how it works with your own supplier.

Your electricity bills can be used as proof of your TV licence payments in the event that an inspector comes to call (they do apparently exist, though they are rarely seen).

The Italian licence fee was added to homeowners’ electricity bills in 2016 due to previously low numbers of households paying the charge in the face of a high rate of television ownership (around 97 percent of households are thought to have at least one TV set in Italy).

If for any reason you don’t have an electricity contract but do have a television, you’ll be required to pay by completing and submitting form F24 with the Agenzia delle Entrate (Italy’s tax agency). The deadline to submit the form is January 31st of each year.

The licence (and associated payments) renews automatically every year unless you have the right to opt out.

Do I need more than one licence if I own more than one property?

If you own a second Italian property, such as a holiday home, you won’t need a second TV licence and you’ll pay the fee as part of the electricity bills of the Italian house where you have legal residence.

The Italian tax agency states that the “fee is owed only once in relation to all the devices owned by the members of the same household, regardless of the number of houses where TV devices are located”.

How do I opt out of paying?

While paying the fee is fairly simple, things become more complicated when you don’t have to pay it.

Three categories are exempt from payment:

- People aged over 75 with an annual household income of 8,000 euros or lower

- People who don't own a television

- Foreign diplomats and military personnel

In order to claim any of these exemptions, you must complete and submit the corresponding form from Italy’s tax agency (Agenzia delle Entrate), which can be downloaded from their website.

For those who don't own a TV, the deadline to submit the exemption form is January 31st of each year.

Missing the end-of-January deadline is costly as it means you’ll need to pay the licence fee for the following six months, after which you’ll be able to claim an exemption for the second half of the year (the deadline is June 30th).

A non-TV-owner exemption must also be requested annually, meaning you’ll have to resubmit the form at the start of every year.

I don’t have a TV. How do I complete the exemption form?

In order to claim a non-TV-owner exemption for the whole year, you must complete and submit the form (Modello di dichiarazione sostitutiva relativa al canone di abbonamento) from Italy’s Agenzia delle Entrate by January 31st.

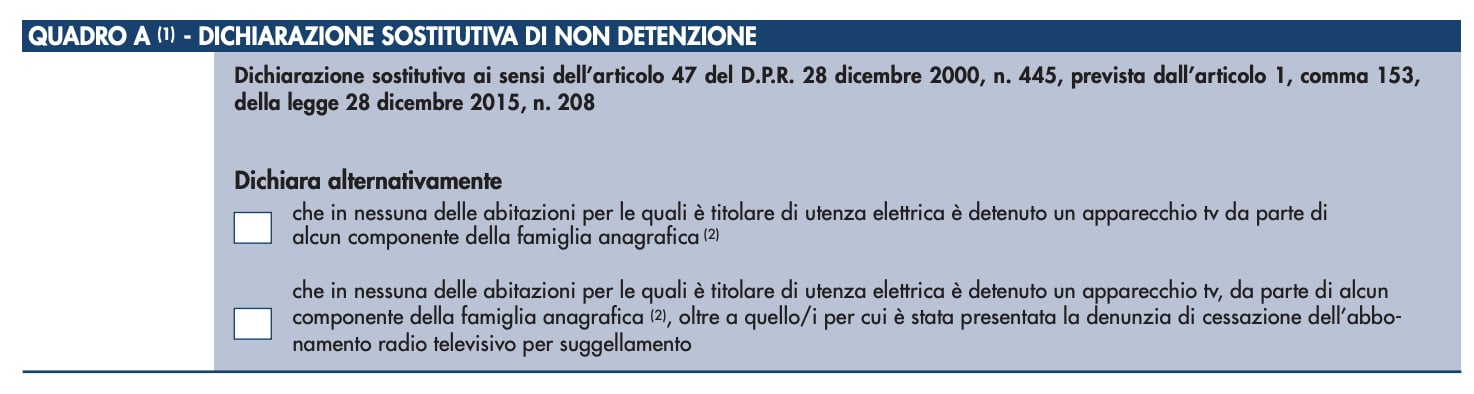

Enter your personal details and then tick the first option within the Quadro A section, which serves as a declaration that “no member of the household owns a TV in any of the owned houses”.

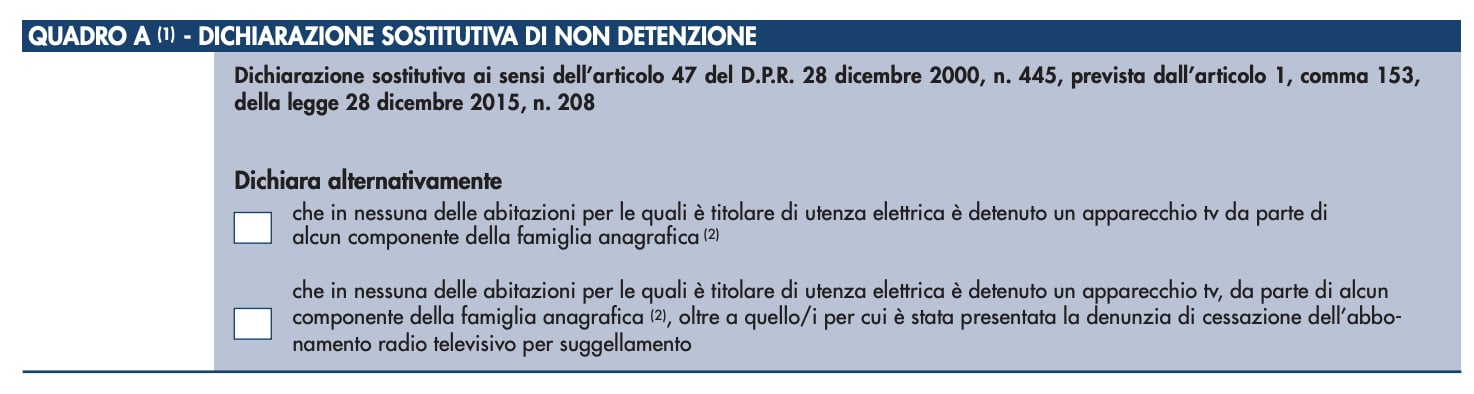

Image: Agenzia delle Entrate.

Image: Agenzia delle Entrate.

The form can be submitted online if you have a SPID (electronic ID code) or an electronic ID card (or CIE). If you don’t have either, you can print out the form and mail it to the address provided on the tax agency website along with a copy of a valid ID document.

This type of exemption must be requested annually, meaning you’ll have to resubmit the form at the start of every year.

READ ALSO: What is a SPID and how do you get one?

Missing the end-of-January deadline is costly as it means you’ll need to pay the licence fee for the following six months, after which you’ll be able to claim an exemption for the second half of the year (the deadline is June 30th).

Claiming the other two exemptions

The process to claim any one of the other two exemptions (people aged over 75s and foreign diplomats or military personnel) is pretty much the same as that for those who don’t own a TV, save for one major difference: these exemptions don’t have to be renewed annually.

The forms for both exemptions can be downloaded from the Italian tax agency website.

What happens if I don’t pay?

Those who fail to pay the TV licence fee (and have no valid exemptions) could face a fine of up to €516, as well as being liable for the payment of up to ten years’ worth of unpaid fees.

The higher fine will be applied if you have submitted an exemption form claiming not to own a television when you actually do.

For more details about paying the canone, see the Agenzie delle Entrate website.

Comments (4)

See Also

Who needs to pay?

If you own a house in Italy and have one or more television sets in it, you’ll have to pay the national TV licence fee (canone).

This goes for both Italian residents and foreign residents who own property in the country.

How do I pay?

Paying the TV licence fee in Italy is relatively straightforward as it’s automatically added to a household’s electricity bill (no prior arrangement is required).

In most cases, it’ll show up as a seven-euro (previously nine-euro) monthly charge on electricity bills from January to October, for a total of 70 euros.

Some energy providers may occasionally bill it differently, which is why it's advisable to check exactly how it works with your own supplier.

Your electricity bills can be used as proof of your TV licence payments in the event that an inspector comes to call (they do apparently exist, though they are rarely seen).

The Italian licence fee was added to homeowners’ electricity bills in 2016 due to previously low numbers of households paying the charge in the face of a high rate of television ownership (around 97 percent of households are thought to have at least one TV set in Italy).

If for any reason you don’t have an electricity contract but do have a television, you’ll be required to pay by completing and submitting form F24 with the Agenzia delle Entrate (Italy’s tax agency). The deadline to submit the form is January 31st of each year.

The licence (and associated payments) renews automatically every year unless you have the right to opt out.

Do I need more than one licence if I own more than one property?

If you own a second Italian property, such as a holiday home, you won’t need a second TV licence and you’ll pay the fee as part of the electricity bills of the Italian house where you have legal residence.

The Italian tax agency states that the “fee is owed only once in relation to all the devices owned by the members of the same household, regardless of the number of houses where TV devices are located”.

How do I opt out of paying?

While paying the fee is fairly simple, things become more complicated when you don’t have to pay it.

Three categories are exempt from payment:

- People aged over 75 with an annual household income of 8,000 euros or lower

- People who don't own a television

- Foreign diplomats and military personnel

In order to claim any of these exemptions, you must complete and submit the corresponding form from Italy’s tax agency (Agenzia delle Entrate), which can be downloaded from their website.

For those who don't own a TV, the deadline to submit the exemption form is January 31st of each year.

Missing the end-of-January deadline is costly as it means you’ll need to pay the licence fee for the following six months, after which you’ll be able to claim an exemption for the second half of the year (the deadline is June 30th).

A non-TV-owner exemption must also be requested annually, meaning you’ll have to resubmit the form at the start of every year.

I don’t have a TV. How do I complete the exemption form?

In order to claim a non-TV-owner exemption for the whole year, you must complete and submit the form (Modello di dichiarazione sostitutiva relativa al canone di abbonamento) from Italy’s Agenzia delle Entrate by January 31st.

Enter your personal details and then tick the first option within the Quadro A section, which serves as a declaration that “no member of the household owns a TV in any of the owned houses”.

The form can be submitted online if you have a SPID (electronic ID code) or an electronic ID card (or CIE). If you don’t have either, you can print out the form and mail it to the address provided on the tax agency website along with a copy of a valid ID document.

This type of exemption must be requested annually, meaning you’ll have to resubmit the form at the start of every year.

READ ALSO: What is a SPID and how do you get one?

Missing the end-of-January deadline is costly as it means you’ll need to pay the licence fee for the following six months, after which you’ll be able to claim an exemption for the second half of the year (the deadline is June 30th).

Claiming the other two exemptions

The process to claim any one of the other two exemptions (people aged over 75s and foreign diplomats or military personnel) is pretty much the same as that for those who don’t own a TV, save for one major difference: these exemptions don’t have to be renewed annually.

The forms for both exemptions can be downloaded from the Italian tax agency website.

What happens if I don’t pay?

Those who fail to pay the TV licence fee (and have no valid exemptions) could face a fine of up to €516, as well as being liable for the payment of up to ten years’ worth of unpaid fees.

The higher fine will be applied if you have submitted an exemption form claiming not to own a television when you actually do.

For more details about paying the canone, see the Agenzie delle Entrate website.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.