'It's so frustrating': My 25-year Italian property renovation nightmare

When US-based Davide Fionda embarked on renovating his mother's Italian property, he couldn't have imagined the obstacles and the timescale in store.

Building a home in Italy was almost inevitable for Davide, as he's been visiting the same area in the Le Marche region, where his Italian-born mother grew up, since he was five years old.

Although he lives in Boston, US, and speaks with a charming East Coast twang, he's also an Italian citizen and has long dreamed of having his own place to stay for the summer.

He began making this dream a reality back in 1997, when a barn that had been in his mother's family for generations, in the village of Schito-Case Duca, was damaged by an earthquake.

"My mother, who had both her mother and sister in Italy, decided that it would be really nice for us to build our own new home instead of relying on family to host us each time we visit," Davide said.

"The goal was simple. I would acquire the barn from my mom, renovate it and move in for the summers, as I'm a college teacher and can spend time in Italy," he added.

"Simple" the goal may have been, but the project itself proved anything but, as Davide came up against unforeseen bureaucratic problems, legal hiccups and personal disappointments.

READ ALSO: The hidden costs of buying a home in Italy

As a former entrepreneur in his professional life, he said he's "used to getting things done", owning five companies and selling three.

But conquering Italian property renovation is his biggest challenge to date: "Never in my life have I had so many complications as I’ve had with this house," he told us.

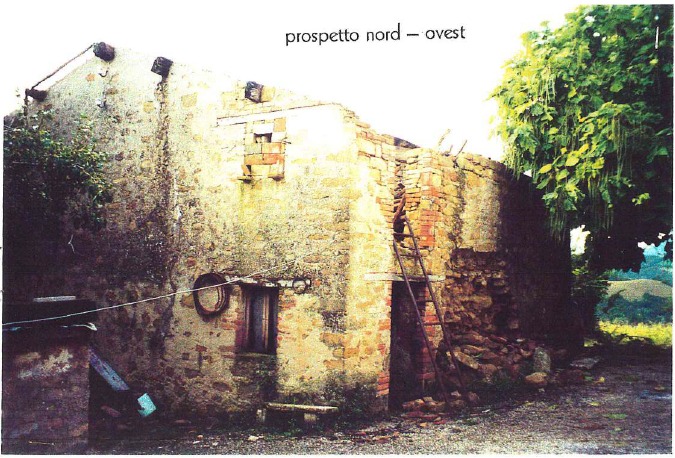

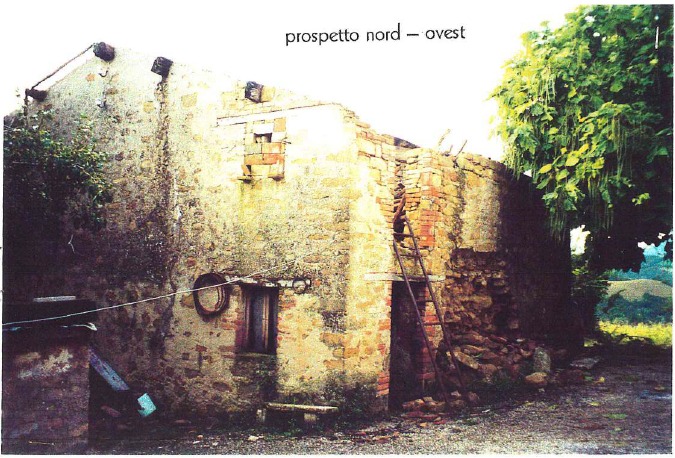

The earthquake-damaged barn. Photo: Davide Fionda

"In the beginning, I knew exactly what I needed and the costs to carry out the project. My mother was, and is still, living in the United States: the project started when she was approached by her godson, who is a geometra (civil engineer), to help her rebuild this barn.

"I started with what I could control. I sat down with an architect and we created a design. I did research on furniture and fixtures. But then the problems started," Davide said.

His mother wanted a simple design: an open plan house with floor-to-ceiling windows facing the mountains, spanning two floors - a ground floor and a first floor for the bedrooms.

When they went to look at the progress in 2004, he said they were "horrified" at what they saw.

"Instead of windows across the front as we asked for, with views of the spectacular Gran Sasso mountains, he took the entire view with two hallways for entering the property and for the bathroom. The bedrooms upstairs were unusable," he added.

Davide describes himself as "not a typical Italian", at two metres in height ,and says he always looks for suitable showers and beds when visiting Italy.

It was one of the reasons building his own home was so attractive, as he could custom-make it to fit his needs.

READ ALSO: What taxes do you need to pay if you own a second home in Italy?

But when they viewed the build, he discovered the first floor had ceilings of just one metre and 40 centimetres - not liveable for most people, never mind someone with Davide's towering frame.

The results didn't match the renovation plans that had been filed with the comune (town hall) - they wouldn't have been approved otherwise, as Davide discovered Italian regulations deemed this height of ceiling in a bedroom uninhabitable.

He said he grew up with the geometra and knew him well, saying they were "best friends". However, on raising the problems with him, Davide said the building professional "refused to fix the house", adding, "he took my mother's money and built a house with no bedrooms".

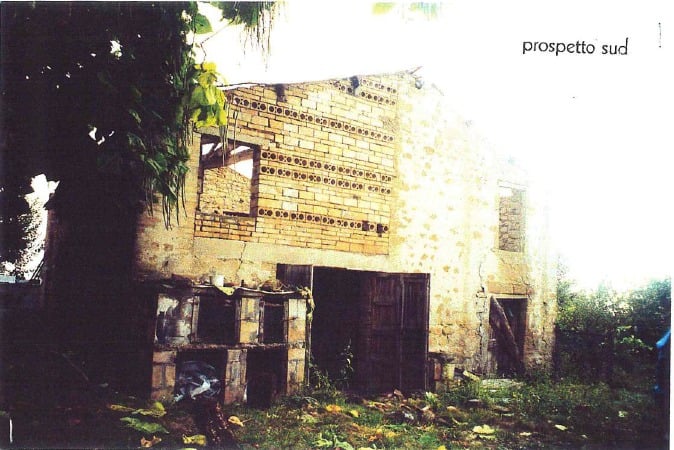

He said his mother decided to stop construction after spending almost $100,000 on a house that they "could not live in", adding that they "returned many times over the years to see the shell of the building that we thought we were going to call our home".

READ ALSO: My Italian Home: How one ‘bargain basement’ renovation ended up costing over €300K

Faced with a stalled project and unsure what to do next, Davide tried to sell the property but got nowhere. He said the "market wasn't right" for selling it, so he considered his options for fixing the botched renovations to date.

His Italian property project has been stalled for over two decades. Photo: Davide Fionda

Then, eventually, in January of this year he decided "he was sick of looking at it and it was time to act".

He intended to use Italy's Bonus ristrutturazioni (Renovation bonus), which allows homeowners to apply for a 50 percent tax reduction on carrying out renovation work.

On asking for professional opinions on whether the house qualified for this bonus, he said he asked five different people and got five different answers.

In the end, he discovered it was eligible and so he could, in theory, proceed with his latest plans.

READ ALSO:

- Budget 2022: Which of Italy’s building bonuses have been extended?

- Property: Do you have to be Italian to claim Italy’s building bonuses?

The aim is to create his mother's original vision - an open plan space with huge windows overlooking the mountains and bedrooms on the first floor - but habitable this time.

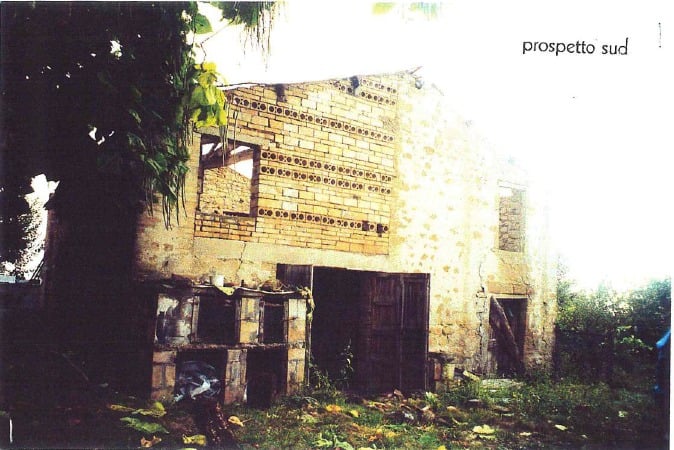

Since the beginning of this year, however, Davide has been stuck and hasn't made progress.

Setbacks have included trying to get a permit to renovate the house, which has proved difficult since the first geometra reportedly didn't update the changes to the building.

This thorny issue goes back to exactly who owned the house, as Davide told us it had been sectioned off and parts of the house were owned by various members of the family.

The building headaches roll on for Davide. Photo by Martin Dalsgaard on Unsplash

"Italian law makes you want to rip your hair out," he said.

Getting the deed in his name has been a huge obstacle in itself, as his mother wasn't the sole owner and some parts of the land that belonged to her were never recorded.

It's meant months of waiting while archives have been searched and deeds have been drawn up and transferred, made all the trickier by coordinating it all from thousands of miles away.

Plus, the house category was never changed to a residential one, listed previously as farmland and therefore illegal to live in.

It's just more unexpected bureaucracy for a project that seems to have no end.

"It has been months and months of all these twists and turns, it’s so frustrating," he told us.

"This has been a 25-year nightmare," he added.

A partly restored, but unliveable barn for Davide now. Photo: Davaide Fionda.

Although Davide had originally planned to sort out the more practical parts of the project by the end of May, with a ticket booked to Italy to choose the windows, he's still stuck in the paperwork part and can't move forward.

"Nothing has happened since January. Three or four times I said, 'screw this'. But it's not in my DNA to give up," he said.

Although he has a strong will, the house has taken its toll on him.

"Every time we go, this house stares us in the face and it’s upsetting. Family always ask us, 'when are you going to finish the house?' It's a real source of heartache," he told us.

From this point, he hopes the paperwork will be completed by August and then he can meet with the contractors to get the process started.

That in itself was a tall order, due to the construction demand and shortage of building companies Italy is currently experiencing.

READ ALSO:

- Italy's building superbonus: What's the problem with credit transfers?

- How Italy’s building bonus uncertainty is causing headaches for homeowners

- Nine things we’ve learned about claiming Italy’s building ‘superbonus’

It's a problem made even more challenging by the fact that he's based in the States and had to find a company that would apply for the credit for the bonus on his behalf.

Despite it all, he's hopeful that he will get the house they dreamed of by next August and says he's learned a lot about renovating property in Italy.

For other would-be home renovators, he advised people to "adjust their timeframe expectations" and expect "anything to do with land or real estate to take forever".

So what is his secret for not giving up, despite the rollercoaster of events and emotions?

It seems he's holding on to his vision of blissful summers in il bel paese.

"The beauty of Italy is to be, sit in a town square and have conversations," he told us.

"It’s a beautiful thing."

See more in The Local’s Italian property section.

Comments (2)

See Also

Building a home in Italy was almost inevitable for Davide, as he's been visiting the same area in the Le Marche region, where his Italian-born mother grew up, since he was five years old.

Although he lives in Boston, US, and speaks with a charming East Coast twang, he's also an Italian citizen and has long dreamed of having his own place to stay for the summer.

He began making this dream a reality back in 1997, when a barn that had been in his mother's family for generations, in the village of Schito-Case Duca, was damaged by an earthquake.

"My mother, who had both her mother and sister in Italy, decided that it would be really nice for us to build our own new home instead of relying on family to host us each time we visit," Davide said.

"The goal was simple. I would acquire the barn from my mom, renovate it and move in for the summers, as I'm a college teacher and can spend time in Italy," he added.

"Simple" the goal may have been, but the project itself proved anything but, as Davide came up against unforeseen bureaucratic problems, legal hiccups and personal disappointments.

READ ALSO: The hidden costs of buying a home in Italy

As a former entrepreneur in his professional life, he said he's "used to getting things done", owning five companies and selling three.

But conquering Italian property renovation is his biggest challenge to date: "Never in my life have I had so many complications as I’ve had with this house," he told us.

"In the beginning, I knew exactly what I needed and the costs to carry out the project. My mother was, and is still, living in the United States: the project started when she was approached by her godson, who is a geometra (civil engineer), to help her rebuild this barn.

"I started with what I could control. I sat down with an architect and we created a design. I did research on furniture and fixtures. But then the problems started," Davide said.

His mother wanted a simple design: an open plan house with floor-to-ceiling windows facing the mountains, spanning two floors - a ground floor and a first floor for the bedrooms.

When they went to look at the progress in 2004, he said they were "horrified" at what they saw.

"Instead of windows across the front as we asked for, with views of the spectacular Gran Sasso mountains, he took the entire view with two hallways for entering the property and for the bathroom. The bedrooms upstairs were unusable," he added.

Davide describes himself as "not a typical Italian", at two metres in height ,and says he always looks for suitable showers and beds when visiting Italy.

It was one of the reasons building his own home was so attractive, as he could custom-make it to fit his needs.

READ ALSO: What taxes do you need to pay if you own a second home in Italy?

But when they viewed the build, he discovered the first floor had ceilings of just one metre and 40 centimetres - not liveable for most people, never mind someone with Davide's towering frame.

The results didn't match the renovation plans that had been filed with the comune (town hall) - they wouldn't have been approved otherwise, as Davide discovered Italian regulations deemed this height of ceiling in a bedroom uninhabitable.

He said he grew up with the geometra and knew him well, saying they were "best friends". However, on raising the problems with him, Davide said the building professional "refused to fix the house", adding, "he took my mother's money and built a house with no bedrooms".

He said his mother decided to stop construction after spending almost $100,000 on a house that they "could not live in", adding that they "returned many times over the years to see the shell of the building that we thought we were going to call our home".

READ ALSO: My Italian Home: How one ‘bargain basement’ renovation ended up costing over €300K

Faced with a stalled project and unsure what to do next, Davide tried to sell the property but got nowhere. He said the "market wasn't right" for selling it, so he considered his options for fixing the botched renovations to date.

Then, eventually, in January of this year he decided "he was sick of looking at it and it was time to act".

He intended to use Italy's Bonus ristrutturazioni (Renovation bonus), which allows homeowners to apply for a 50 percent tax reduction on carrying out renovation work.

On asking for professional opinions on whether the house qualified for this bonus, he said he asked five different people and got five different answers.

In the end, he discovered it was eligible and so he could, in theory, proceed with his latest plans.

READ ALSO:

- Budget 2022: Which of Italy’s building bonuses have been extended?

- Property: Do you have to be Italian to claim Italy’s building bonuses?

The aim is to create his mother's original vision - an open plan space with huge windows overlooking the mountains and bedrooms on the first floor - but habitable this time.

Since the beginning of this year, however, Davide has been stuck and hasn't made progress.

Setbacks have included trying to get a permit to renovate the house, which has proved difficult since the first geometra reportedly didn't update the changes to the building.

This thorny issue goes back to exactly who owned the house, as Davide told us it had been sectioned off and parts of the house were owned by various members of the family.

"Italian law makes you want to rip your hair out," he said.

Getting the deed in his name has been a huge obstacle in itself, as his mother wasn't the sole owner and some parts of the land that belonged to her were never recorded.

It's meant months of waiting while archives have been searched and deeds have been drawn up and transferred, made all the trickier by coordinating it all from thousands of miles away.

Plus, the house category was never changed to a residential one, listed previously as farmland and therefore illegal to live in.

It's just more unexpected bureaucracy for a project that seems to have no end.

"It has been months and months of all these twists and turns, it’s so frustrating," he told us.

"This has been a 25-year nightmare," he added.

Although Davide had originally planned to sort out the more practical parts of the project by the end of May, with a ticket booked to Italy to choose the windows, he's still stuck in the paperwork part and can't move forward.

"Nothing has happened since January. Three or four times I said, 'screw this'. But it's not in my DNA to give up," he said.

Although he has a strong will, the house has taken its toll on him.

"Every time we go, this house stares us in the face and it’s upsetting. Family always ask us, 'when are you going to finish the house?' It's a real source of heartache," he told us.

From this point, he hopes the paperwork will be completed by August and then he can meet with the contractors to get the process started.

That in itself was a tall order, due to the construction demand and shortage of building companies Italy is currently experiencing.

READ ALSO:

- Italy's building superbonus: What's the problem with credit transfers?

- How Italy’s building bonus uncertainty is causing headaches for homeowners

- Nine things we’ve learned about claiming Italy’s building ‘superbonus’

It's a problem made even more challenging by the fact that he's based in the States and had to find a company that would apply for the credit for the bonus on his behalf.

Despite it all, he's hopeful that he will get the house they dreamed of by next August and says he's learned a lot about renovating property in Italy.

For other would-be home renovators, he advised people to "adjust their timeframe expectations" and expect "anything to do with land or real estate to take forever".

So what is his secret for not giving up, despite the rollercoaster of events and emotions?

It seems he's holding on to his vision of blissful summers in il bel paese.

"The beauty of Italy is to be, sit in a town square and have conversations," he told us.

"It’s a beautiful thing."

See more in The Local’s Italian property section.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.