What is an Italian commercialista and do you really need one?

If you dread the prospect of filing your Italian tax return or are perplexed by other pieces of essential financial paperwork, you could do as many Italians do and call in a professional. But who should you hire and what exactly can they help with?

“Nothing is certain,” Benjamin Franklin once said, “except for death and taxes.” That phrase is as true in Italy as it was in America — though when it comes time to actually filing your return, you may find yourself very uncertain about how much you actually owe.

Enter the commercialista, Italy’s answer to the chartered accountant — a highly trained financial wizard who, unlike the rest of us, feels no fear in the face of an AA9/12 or a ATECO code (don’t worry about what that is — your commercialista will get it).

What is a commercialista?

Like accountants, commercialisti are experts in tax law and finance who provide a wide range of services to businesses and individuals.

Technically, there is also a tier of tax experts below commercialisti, known as esperti contabili or more commonly as ragionare. They undergo less training than commercialisti, but can provide many of the same accountancy services — unless you need an audit or are a business accessing public funds.

Both are organized and certified as members of a national organization called the Consiglio Nazionale dei Dottori Commercialisti e degli Esperti Contabili (CNDCEC).

Because Italian tax filings for employees are typically pre-completed by the government, accountants are not usually as vital for tax preparation in Italy as they are in Canada or America, where every spring is marked by terror at the thought of another tax return.

READ ALSO: The Italian tax calendar for 2023: Which taxes are due when?

Instead, their services are generally more essential to businesses, who rely on them for a wide range of corporate services. That includes regular audits, bookkeeping, managing the sale of assets, filing VAT returns, and even consultancy on issues related to company law and business administration.

If you’re ever subject to an audit by the Italian government, a commercialista will be the one to represent you in the dispute.

But they also come in very useful if you're self-employed in Italy, as they can help with a number of tedious bureaucratic tasks that self-employed workers must see to.

Do I need a commercialista?

That depends. If you’re an individual with a single employer and a fairly simple tax situation — and if you speak some Italian — the services of a commercialista will probably not be that important to you.

If you do run into issues with your tax return, your situation may be simple enough that you can visit one of Italy’s tax preparation centres (CAF), where experts will help you complete and file a return in Italian at little or no cost.

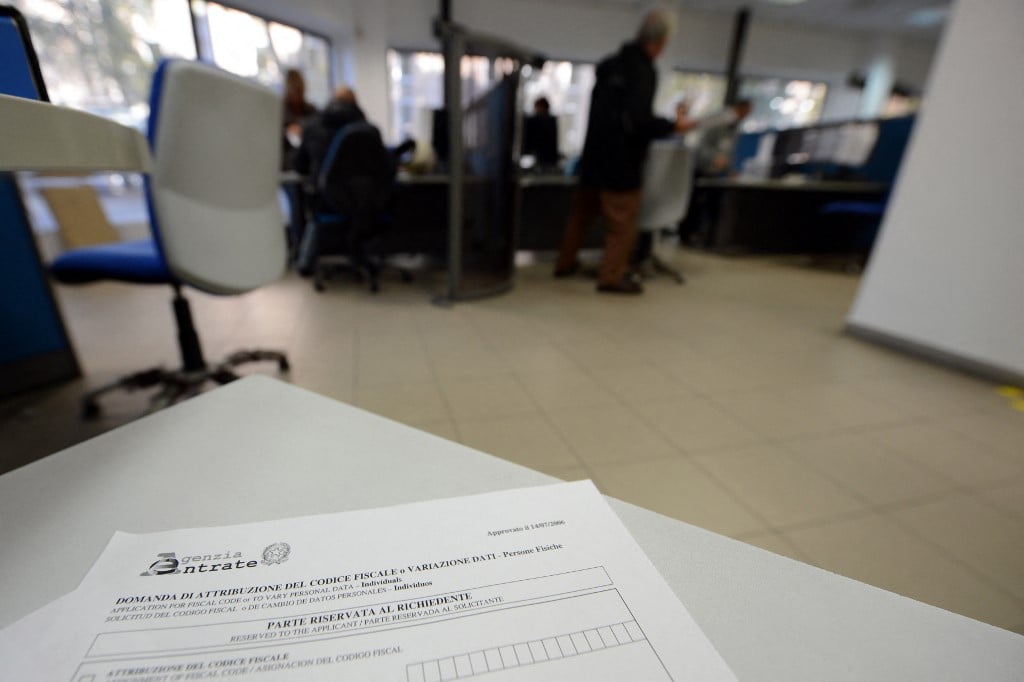

Italian tax forms are not always available in English, making tax matters more challenging for international residents.(Photo by ANDREAS SOLARO / AFP)

If, however, you are self-employed, are starting or operating a business, are receiving pension income from abroad, are earning income in multiple countries, or simply find the whole process difficult, you may find a commercialista helps massively simplify your situation.

READ ALSO: What to know about Italy’s flat tax rate for pensioners

Take the first example. If you are self-employed and earning more than €5,000 per year from work in Italy, you will be required to get a partita IVA (VAT number) and make an annual filing. Both of these processes can be cumbersome, but a commercialista will handle them for you for just a few hundred euro per year.

For partita IVA holders, they can also save time and trouble by navigating Italy's digital invoicing system (including managing the payment of every tax 'stamp', or marca da bollo) on your behalf.

A partita IVA is also a prerequisite for some visa categories, so if your stay in Italy is dependent on a properly filed application it’s strongly recommended you have a professional file for you.

If you’re starting or operating a business, commercialisti can offer the same assistance — and then some. If you’re opening a B&B or flipping a house and want access to public funds, a commercialista is indispensable for keeping up with filing requirements and keeping an eye on any bonuses and rebates you might be eligible for.

If you’re working as a housekeeper or caregiver, you may also consider employing a professional to file a return to ensure you are still contributing necessary tax and national social security amounts. Employers in these categories aren’t obligated to deduct tax and social security from your income.

READ ALSO: Do US nationals in Italy have to pay taxes twice?

Lastly, if your tax situation is complex — if your main source of income is a pension from abroad but you also do work in Italy, for example, or if you work freelance between several countries and claim tax residency in Italy — a commercialista will be able to figure out exactly how much tax you owe and how much you can legally avoid.

Remember, failing to pay your taxes can come with high penalties in Italy. Commercialisti can be a kind of insurance — though keep in mind that not every accountant is necessarily trustworthy.

When finding a commercialista, make sure to check their references and, to avoid being surprised with a hefty bill, ask for an estimated cost (preventivo) before agreeing to hire them.

How do I find a commercialista?

You can find commercialisti in the pagine gialle (Yellow Pages) or even in a search of Google Maps. All commercialisti must be registered with the national association, so you can also check CNCDEC’s national register.

As with most things in Italy, word of mouth is key. Ask friends and family for recommendations if you can. Expat message boards and websites also often share names of professionals that are particularly experienced in international tax law.

Comments

See Also

“Nothing is certain,” Benjamin Franklin once said, “except for death and taxes.” That phrase is as true in Italy as it was in America — though when it comes time to actually filing your return, you may find yourself very uncertain about how much you actually owe.

Enter the commercialista, Italy’s answer to the chartered accountant — a highly trained financial wizard who, unlike the rest of us, feels no fear in the face of an AA9/12 or a ATECO code (don’t worry about what that is — your commercialista will get it).

What is a commercialista?

Like accountants, commercialisti are experts in tax law and finance who provide a wide range of services to businesses and individuals.

Technically, there is also a tier of tax experts below commercialisti, known as esperti contabili or more commonly as ragionare. They undergo less training than commercialisti, but can provide many of the same accountancy services — unless you need an audit or are a business accessing public funds.

Both are organized and certified as members of a national organization called the Consiglio Nazionale dei Dottori Commercialisti e degli Esperti Contabili (CNDCEC).

Because Italian tax filings for employees are typically pre-completed by the government, accountants are not usually as vital for tax preparation in Italy as they are in Canada or America, where every spring is marked by terror at the thought of another tax return.

READ ALSO: The Italian tax calendar for 2023: Which taxes are due when?

Instead, their services are generally more essential to businesses, who rely on them for a wide range of corporate services. That includes regular audits, bookkeeping, managing the sale of assets, filing VAT returns, and even consultancy on issues related to company law and business administration.

If you’re ever subject to an audit by the Italian government, a commercialista will be the one to represent you in the dispute.

But they also come in very useful if you're self-employed in Italy, as they can help with a number of tedious bureaucratic tasks that self-employed workers must see to.

Do I need a commercialista?

That depends. If you’re an individual with a single employer and a fairly simple tax situation — and if you speak some Italian — the services of a commercialista will probably not be that important to you.

If you do run into issues with your tax return, your situation may be simple enough that you can visit one of Italy’s tax preparation centres (CAF), where experts will help you complete and file a return in Italian at little or no cost.

If, however, you are self-employed, are starting or operating a business, are receiving pension income from abroad, are earning income in multiple countries, or simply find the whole process difficult, you may find a commercialista helps massively simplify your situation.

READ ALSO: What to know about Italy’s flat tax rate for pensioners

Take the first example. If you are self-employed and earning more than €5,000 per year from work in Italy, you will be required to get a partita IVA (VAT number) and make an annual filing. Both of these processes can be cumbersome, but a commercialista will handle them for you for just a few hundred euro per year.

For partita IVA holders, they can also save time and trouble by navigating Italy's digital invoicing system (including managing the payment of every tax 'stamp', or marca da bollo) on your behalf.

A partita IVA is also a prerequisite for some visa categories, so if your stay in Italy is dependent on a properly filed application it’s strongly recommended you have a professional file for you.

If you’re starting or operating a business, commercialisti can offer the same assistance — and then some. If you’re opening a B&B or flipping a house and want access to public funds, a commercialista is indispensable for keeping up with filing requirements and keeping an eye on any bonuses and rebates you might be eligible for.

If you’re working as a housekeeper or caregiver, you may also consider employing a professional to file a return to ensure you are still contributing necessary tax and national social security amounts. Employers in these categories aren’t obligated to deduct tax and social security from your income.

READ ALSO: Do US nationals in Italy have to pay taxes twice?

Lastly, if your tax situation is complex — if your main source of income is a pension from abroad but you also do work in Italy, for example, or if you work freelance between several countries and claim tax residency in Italy — a commercialista will be able to figure out exactly how much tax you owe and how much you can legally avoid.

Remember, failing to pay your taxes can come with high penalties in Italy. Commercialisti can be a kind of insurance — though keep in mind that not every accountant is necessarily trustworthy.

When finding a commercialista, make sure to check their references and, to avoid being surprised with a hefty bill, ask for an estimated cost (preventivo) before agreeing to hire them.

How do I find a commercialista?

You can find commercialisti in the pagine gialle (Yellow Pages) or even in a search of Google Maps. All commercialisti must be registered with the national association, so you can also check CNCDEC’s national register.

As with most things in Italy, word of mouth is key. Ask friends and family for recommendations if you can. Expat message boards and websites also often share names of professionals that are particularly experienced in international tax law.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.