What’s the difference between Italy’s city taxes and new ‘tourist tax’?

As Venice trials its new entrance fee for tourists, visitors may wonder how the new charge differs from existing 'tourist taxes' in Italian cities - and what the revenue is used for.

The city of Venice recently approved a long-debated 'tourist tax', or entry fee, which was trialled for the first time on Thursday, April 25th, 2024.

But, as regular visitors will know, Venice and many other Italian cities already have a 'tourist tax' in place.

So what exactly is the difference, and is this an additional charge?

The city 'tourist tax'

Italy's existing 'tourist tax', officially known as an imposta di soggiorno, is a charge imposed by some town and city authorities on visitors staying in accommodation overnight.

The charge is applied at hotels, B&Bs, vacation rentals, hostels, campsites, etc. and is to be paid directly to the accommodation provider. It is often requested in cash.

It's entirely up to each local authority whether, and how, it decided to charge such a tax, but as of 2023 around 1,000 towns and cities in Italy had one in place.

The rate varies by city and by type of accommodation. For example, Rome’s tourist tax rates vary from €3.50 to €10 per person per night.

If you're a family staying at a hotel for several nights, this can add up to a significant extra cost - though under-tens are exempt from the charge in Rome (the age limit and other exemptions vary by city.)

Venice has the same type of tax on overnight stays, which varies between €1-5 per person per night.

READ ALSO: Is Como really bringing in a Venice-style ‘tourist tax’?

The idea behind the charge is that visitors benefit from services normally paid for in tax by residents (such as waste disposal, building maintenance and subsidised public transport) and that this helps offset the cost to the local authority of providing those services.

The money raised via these taxes is usually earmarked by the local authority for public services that benefit both visitors and residents.

Venice's new 'tourist tax'

The new charge in Venice, known officially as the Contributo di Accesso or 'Venice Access Fee', is instead aimed at turisti giornalieri (day-trippers).

While it is also often referred to as a 'tourist tax', in practice it's more like an entry fee for the city’s centro storico (historic centre).

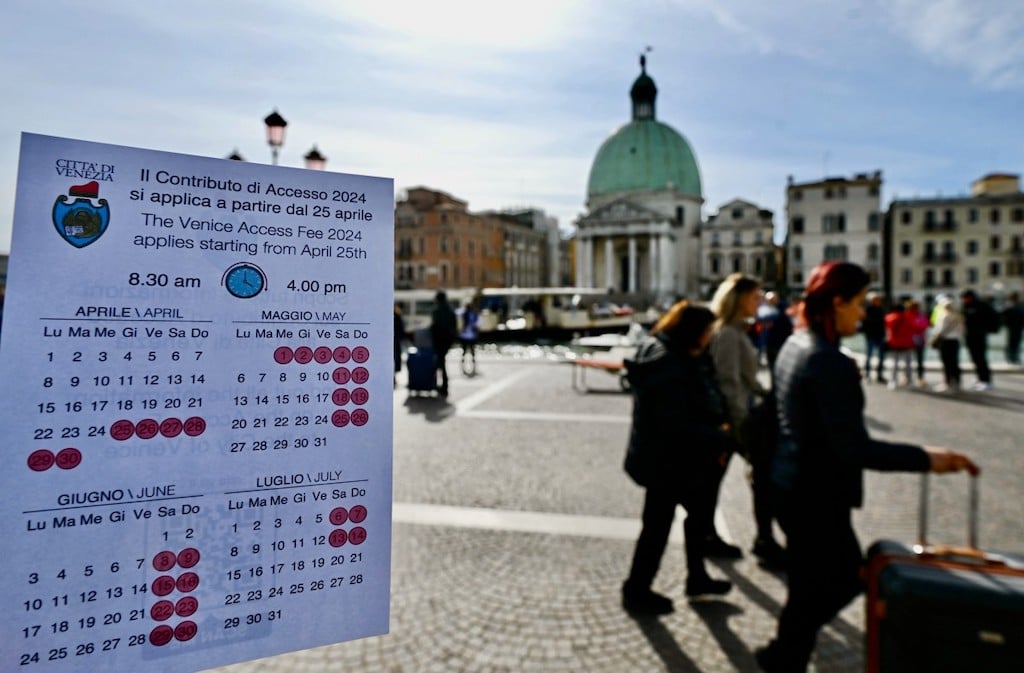

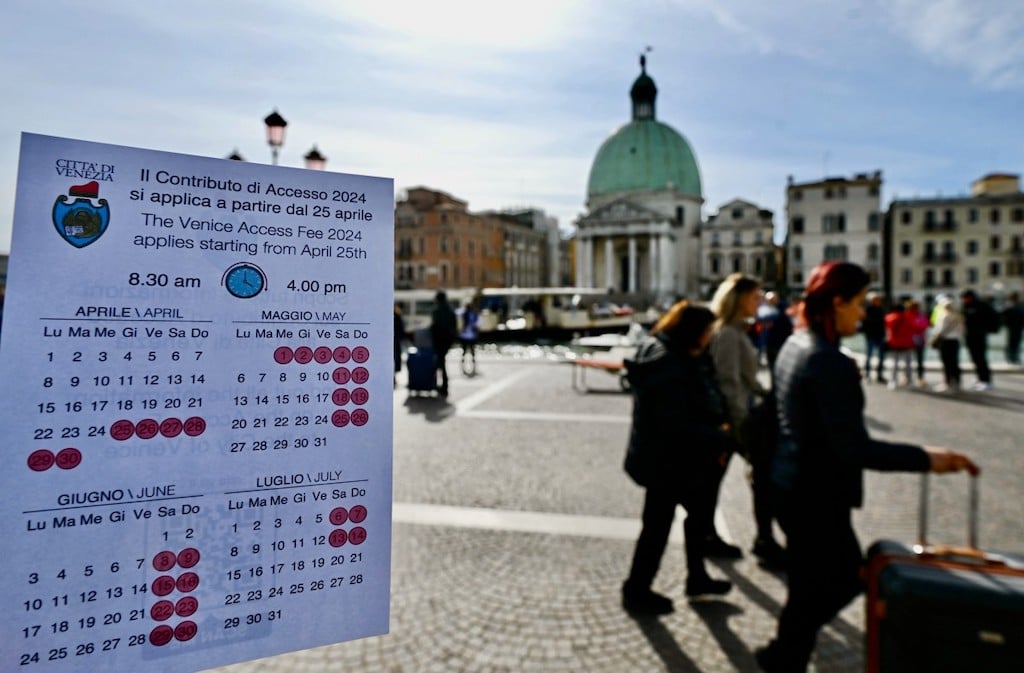

City authorities say the €5 charge, which will apply over 29 of the busiest travel dates in 2024, is designed to help control crowds in the city and lessen the impact of mass tourism on the city's fragile infrastructure.

A person shows a calendar of the paying days to visit Venice in 2024. Photo by GABRIEL BOUYS / AFP.

Venice city council has said that all visitors aged 14 or over arriving between 8.30am and 4pm on these dates will have to pay the fee, unless they're staying overnight.

Anyone staying at accommodation in the lagoon city would be exempt from the charge - but they would instead need to pay the existing city charge applied to overnight stays.

READ ALSO: How will Venice’s ‘tourist tax’ work?

It's not yet known whether the charge will remain in place after this initial trial period, and there were no details immediately available as to what the money raised would be spent on - which is one reason the new 'tax' has faced heavy criticism.

In any case, those visiting Venice on the most popular dates this summer will likely be subject to either one of these charges.

No other Italian town or city currently charges an entry fee, though some are reportedly considering it.

Comments

See Also

The city of Venice recently approved a long-debated 'tourist tax', or entry fee, which was trialled for the first time on Thursday, April 25th, 2024.

But, as regular visitors will know, Venice and many other Italian cities already have a 'tourist tax' in place.

So what exactly is the difference, and is this an additional charge?

The city 'tourist tax'

Italy's existing 'tourist tax', officially known as an imposta di soggiorno, is a charge imposed by some town and city authorities on visitors staying in accommodation overnight.

The charge is applied at hotels, B&Bs, vacation rentals, hostels, campsites, etc. and is to be paid directly to the accommodation provider. It is often requested in cash.

It's entirely up to each local authority whether, and how, it decided to charge such a tax, but as of 2023 around 1,000 towns and cities in Italy had one in place.

The rate varies by city and by type of accommodation. For example, Rome’s tourist tax rates vary from €3.50 to €10 per person per night.

If you're a family staying at a hotel for several nights, this can add up to a significant extra cost - though under-tens are exempt from the charge in Rome (the age limit and other exemptions vary by city.)

Venice has the same type of tax on overnight stays, which varies between €1-5 per person per night.

READ ALSO: Is Como really bringing in a Venice-style ‘tourist tax’?

The idea behind the charge is that visitors benefit from services normally paid for in tax by residents (such as waste disposal, building maintenance and subsidised public transport) and that this helps offset the cost to the local authority of providing those services.

The money raised via these taxes is usually earmarked by the local authority for public services that benefit both visitors and residents.

Venice's new 'tourist tax'

The new charge in Venice, known officially as the Contributo di Accesso or 'Venice Access Fee', is instead aimed at turisti giornalieri (day-trippers).

While it is also often referred to as a 'tourist tax', in practice it's more like an entry fee for the city’s centro storico (historic centre).

City authorities say the €5 charge, which will apply over 29 of the busiest travel dates in 2024, is designed to help control crowds in the city and lessen the impact of mass tourism on the city's fragile infrastructure.

Venice city council has said that all visitors aged 14 or over arriving between 8.30am and 4pm on these dates will have to pay the fee, unless they're staying overnight.

Anyone staying at accommodation in the lagoon city would be exempt from the charge - but they would instead need to pay the existing city charge applied to overnight stays.

READ ALSO: How will Venice’s ‘tourist tax’ work?

It's not yet known whether the charge will remain in place after this initial trial period, and there were no details immediately available as to what the money raised would be spent on - which is one reason the new 'tax' has faced heavy criticism.

In any case, those visiting Venice on the most popular dates this summer will likely be subject to either one of these charges.

No other Italian town or city currently charges an entry fee, though some are reportedly considering it.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.