What happens if you miss your tax return deadline in Italy?

The deadline for most employees in Italy to submit their tax return came on Monday. But what happens if you missed this deadline, or any others?

Italians are not generally known for punctuality and strict adherence to rules, but the Agenzia delle Entrate (tax office) is one major exception - deadlines for filing your tax return are set in stone here, just as they are anywhere else.

But what if you procrastinate – or inadvertently overlook a deadline – and submit your dichiarazione dei redditi (tax return) a bit too late? The consequences might not be too serious, but you’ll need to act fast.

Do I need to file an Italian tax return?

If you’re considered a ‘tax resident’ in Italy, you’re liable to pay Italian income tax. This generally applies if you’re legally registered as a resident in Italy, though some non-residents may also need to pay Italian taxes.

Freelancers, pensioners, and some employees will need to file a tax return, with the deadline dates varying depending on your status, and therefore which form you need to use.

If you’re an employee in Italy with no additional sources of income, you’re usually not required to file taxes - though there are numerous exceptions to this rule.

And many employees file one anyway, given that there are so many deductions you can make.

READ ALSO: The Italian tax calendar for 2023: Which taxes are due when?

There are various detrazioni fiscali (tax deductions) possible on expenses such as the cost of medicines, vet bills and school fees.

There's also a long and ever-changing list of different agevolazioni (tax concessions) available in Italy, which includes the famous building 'superbonus' and the low tax offer for people who move to Italy with a foreign pension.

Figuring out which of these deductions you’re entitled to, and applying for them, is a complicated task. This is one reason why so many Italians get help with filing their tax return from a commercialista (accountant) or the tax assistance centre (Centro Assistenza Fiscale, or CAF).

When are the deadlines?

For the tax year 2022, those filing the modello 730 (the most commonly-used form, which employees and retirees will usually need) had until October 2nd, 2023 to file their taxes online, either by themselves or via a tax professional.

Self-employed workers are among those who have until November 30th, 2023 to file using the other type of Italian tax declaration form, called the Modello Redditi Persone Fisiche.

READ ALSO: Five essential things to know about filling out your Italian tax return

Italy’s taxation rules are complex, and it may not always be clear which form you need to use in your circumstances. See more information about the different forms and deadlines here, and always check with a qualified tax advisor if in doubt.

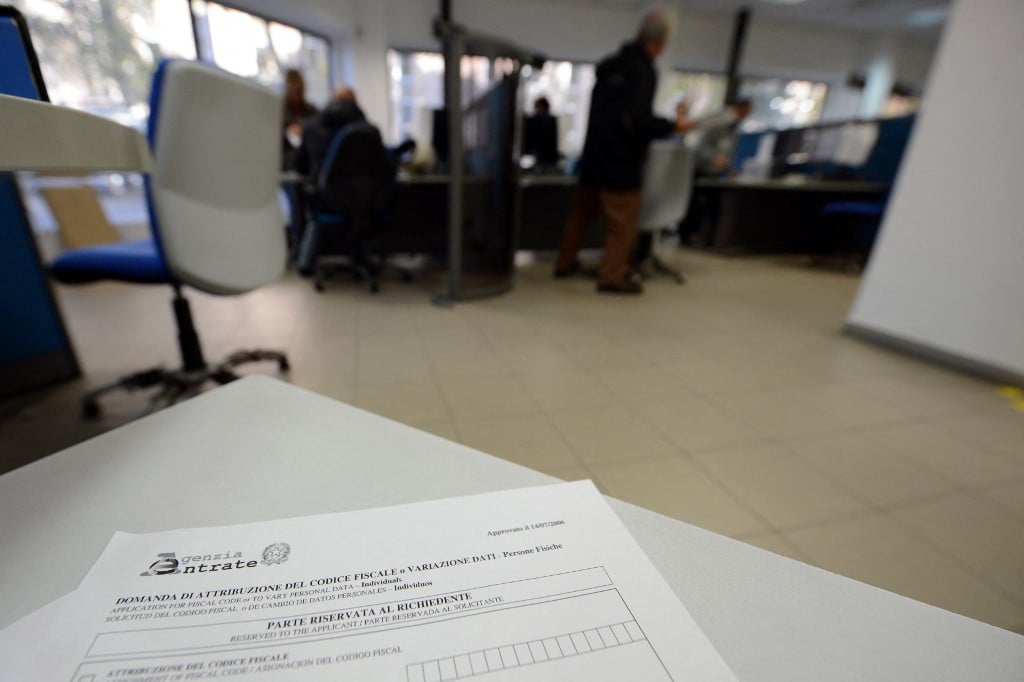

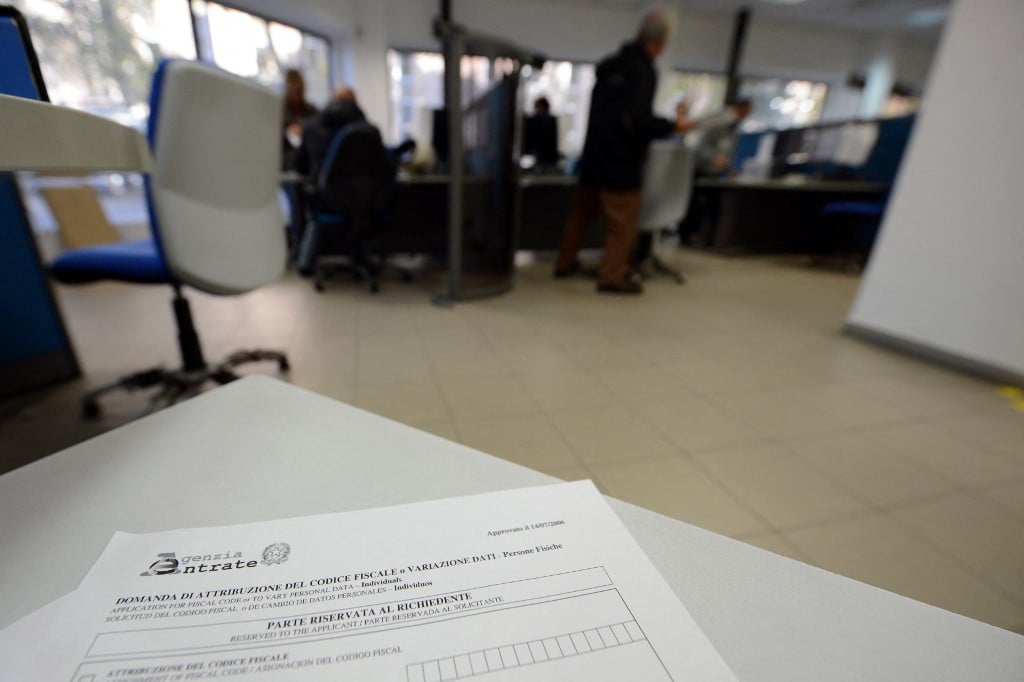

(Photo by ANDREAS SOLARO / AFP)

What happens if I miss a deadline?

Simply letting the deadline pass and hoping that the tax office will forget you is not recommended. Still, the Italian taxman is usually fairly lenient at first, and you won’t be immediately hit with any demands for payment.

In fact it can take a while for the tax authorities to issue a late payment and penalty notice, but you shouldn’t wait for them to do so.

If the tax return is filed within 90 days after the deadline, a penalty will apply but it can be reduced significantly if you act fast.

As tax expert Nicolò Bolla explains on his website: “late filing is punished with a fixed penalty from 250 to 1,000 euros.”

But you could reduce this penalty by as much as 90 percent “if the fine is self-assessed and paid before the tax office prompts any investigation.”

As for how to self-assess a fine and pay it before being issued with a notice, you’re likely to need to enlist the help of an accountant or the CAF to ensure everything is done correctly.

READ ALSO: What is an Italian commercialista and do you really need one?

If you don’t do this within the first 90 days, the tax office will then class you as having failed to file a tax return and a bigger penalty will be imposed.

The amount you’ll be fined in this case depends on various factors, but it is likely to be a minimum of €250, and can total between 120 and 240 percent of the taxes due.

If you’re unhappy with a tax assessment made by the Italian authorities, you can challenge it and appeal to the Courts of Tax Justice (corti di giustizia tributaria). How much this will cost depends on the size of the disputed amount.

See more information on the Italian tax agency’s website.

Please note that The Local cannot provide advice on tax issues. For help with filing taxes in Italy, contact your local tax assistance centre (Centro Assistenza Fiscale, or CAF) or consult an accountant (commercialista) or other qualified tax professional.

Comments

See Also

Italians are not generally known for punctuality and strict adherence to rules, but the Agenzia delle Entrate (tax office) is one major exception - deadlines for filing your tax return are set in stone here, just as they are anywhere else.

But what if you procrastinate – or inadvertently overlook a deadline – and submit your dichiarazione dei redditi (tax return) a bit too late? The consequences might not be too serious, but you’ll need to act fast.

Do I need to file an Italian tax return?

If you’re considered a ‘tax resident’ in Italy, you’re liable to pay Italian income tax. This generally applies if you’re legally registered as a resident in Italy, though some non-residents may also need to pay Italian taxes.

Freelancers, pensioners, and some employees will need to file a tax return, with the deadline dates varying depending on your status, and therefore which form you need to use.

If you’re an employee in Italy with no additional sources of income, you’re usually not required to file taxes - though there are numerous exceptions to this rule.

And many employees file one anyway, given that there are so many deductions you can make.

READ ALSO: The Italian tax calendar for 2023: Which taxes are due when?

There are various detrazioni fiscali (tax deductions) possible on expenses such as the cost of medicines, vet bills and school fees.

There's also a long and ever-changing list of different agevolazioni (tax concessions) available in Italy, which includes the famous building 'superbonus' and the low tax offer for people who move to Italy with a foreign pension.

Figuring out which of these deductions you’re entitled to, and applying for them, is a complicated task. This is one reason why so many Italians get help with filing their tax return from a commercialista (accountant) or the tax assistance centre (Centro Assistenza Fiscale, or CAF).

When are the deadlines?

For the tax year 2022, those filing the modello 730 (the most commonly-used form, which employees and retirees will usually need) had until October 2nd, 2023 to file their taxes online, either by themselves or via a tax professional.

Self-employed workers are among those who have until November 30th, 2023 to file using the other type of Italian tax declaration form, called the Modello Redditi Persone Fisiche.

READ ALSO: Five essential things to know about filling out your Italian tax return

Italy’s taxation rules are complex, and it may not always be clear which form you need to use in your circumstances. See more information about the different forms and deadlines here, and always check with a qualified tax advisor if in doubt.

What happens if I miss a deadline?

Simply letting the deadline pass and hoping that the tax office will forget you is not recommended. Still, the Italian taxman is usually fairly lenient at first, and you won’t be immediately hit with any demands for payment.

In fact it can take a while for the tax authorities to issue a late payment and penalty notice, but you shouldn’t wait for them to do so.

If the tax return is filed within 90 days after the deadline, a penalty will apply but it can be reduced significantly if you act fast.

As tax expert Nicolò Bolla explains on his website: “late filing is punished with a fixed penalty from 250 to 1,000 euros.”

But you could reduce this penalty by as much as 90 percent “if the fine is self-assessed and paid before the tax office prompts any investigation.”

As for how to self-assess a fine and pay it before being issued with a notice, you’re likely to need to enlist the help of an accountant or the CAF to ensure everything is done correctly.

READ ALSO: What is an Italian commercialista and do you really need one?

If you don’t do this within the first 90 days, the tax office will then class you as having failed to file a tax return and a bigger penalty will be imposed.

The amount you’ll be fined in this case depends on various factors, but it is likely to be a minimum of €250, and can total between 120 and 240 percent of the taxes due.

If you’re unhappy with a tax assessment made by the Italian authorities, you can challenge it and appeal to the Courts of Tax Justice (corti di giustizia tributaria). How much this will cost depends on the size of the disputed amount.

See more information on the Italian tax agency’s website.

Please note that The Local cannot provide advice on tax issues. For help with filing taxes in Italy, contact your local tax assistance centre (Centro Assistenza Fiscale, or CAF) or consult an accountant (commercialista) or other qualified tax professional.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.